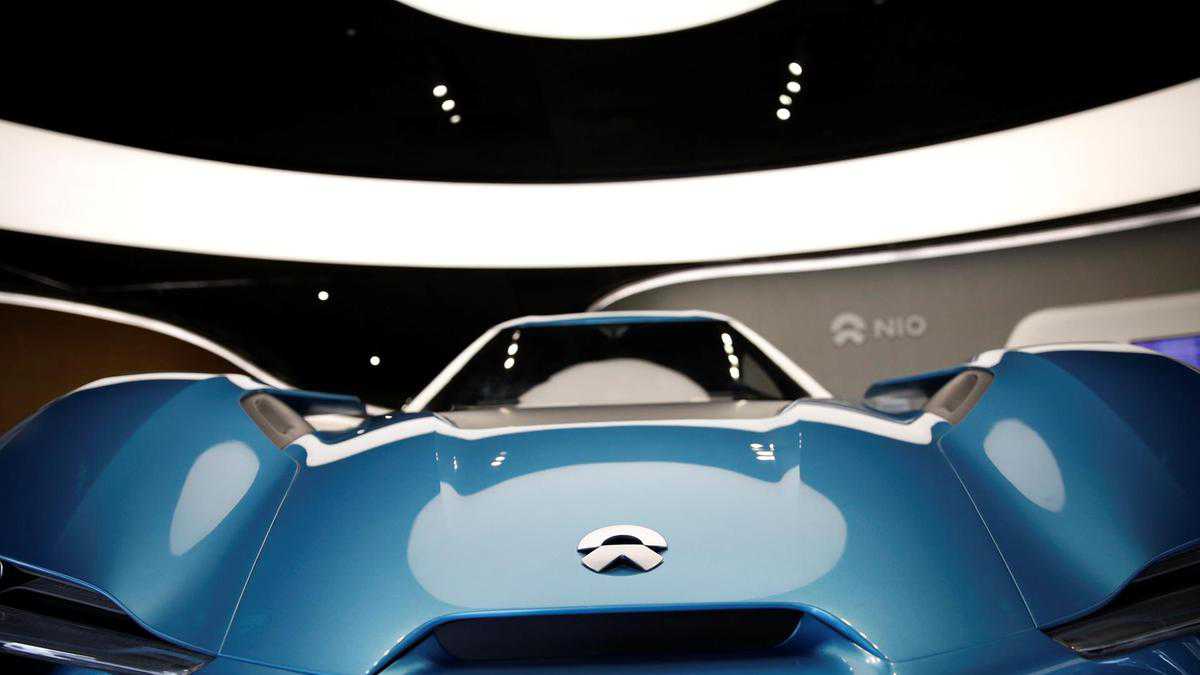

Chinese EV maker Nio's valuation soars higher than General Motors

10 January, 2021

The rally that has lifted the worthiness of Chinese electric carmaker Nio to almost the combined worth of auto behemoths Basic Motors and Ford Electric motor gets another boost as the business prepares to introduce its first-ever sedan on Saturday.

Nio shares soared more than 12-fold this past year, and the share added another 21 % in the primary week of 2021, amid a growing view that electric cars will be the future of the car industry and while Tesla’s valuation climbed to new heights.

As investors were gripped by a mania for everything linked to EVs in 2020, small and newer companies like Nio have grown to be the most recent stock-market darlings as persons search for the next Tesla.

Nio is likely to introduce its initial saloon car in its twelve-monthly “Nio Day” function found in Chengdu, China. The saloon - most likely the to begin several - is definitely the most up-to-date addition to Nio’s current portfolio which includes multiple electrical SUVs and a coupe.

The business reached the milestone of producing and delivering a lot more than 5,000 vehicles in per month in October. Nio features 12 buys, five holds and two markets among analysts and the average price concentrate on at $49. Its American Depositary Receipts shut up 8.6 % at a record most of $58.92 on Friday.

Its new saloon may compete with Tesla’s Model 3 in China, which is Tesla’s most affordable car. Model 3 rates start from 249,900 yuan ($38,597) in China, and its own base model can travelling 263 miles about the same demand. Nio’s Chinese rival XPeng as well teased a fresh saloon on Thursday with an image on Twitter.

It “fits a style we’ve been talking about for a while”, Roth Capital Companions analyst Craig Irwin said. “Tesla will not operate in vacuum pressure, while valuation seems to presume limited if any actual competition.”

While Nio has typically been called the largest Tesla rival in China, analysts usually do not expect it or various other small players in the industry to truly problem its leadership in the area. Tesla’s market worth itself - at a whopping $834 billion - doesn’t seem to be to reflect the possibility of viable competition.

“I wouldn’t expect an excessive amount of impact on Tesla/EV but way more on the gasoline automobiles losing share to the new Nio sedan,” Deutsche Bank analyst Edison Yu stated, discussing Nio’s event.

Mr Yu believes Nio’s new car will come to be positioned as reduced flagship saloon, and thus much like BMW’s 5 Series and 7 Series, and Audi’s A good7. He expects it to sport high-end features, such as for example dual-motor all-wheel-drive, a range of over 400 kilometers, a sporty front side grille, and a suite of next-era autonomous driving-related sensors.

The saloon is also likely to be pricier than Tesla’s Version 3, which is more of a BMW 3 Series competitor, Mr Yu said. “I would guess over 350,000 yuan according to how big is battery,” he added.

Source: www.thenationalnews.com

TAG(s):