Fintech company Ripple sets up regional base in DIFC

08 November, 2020

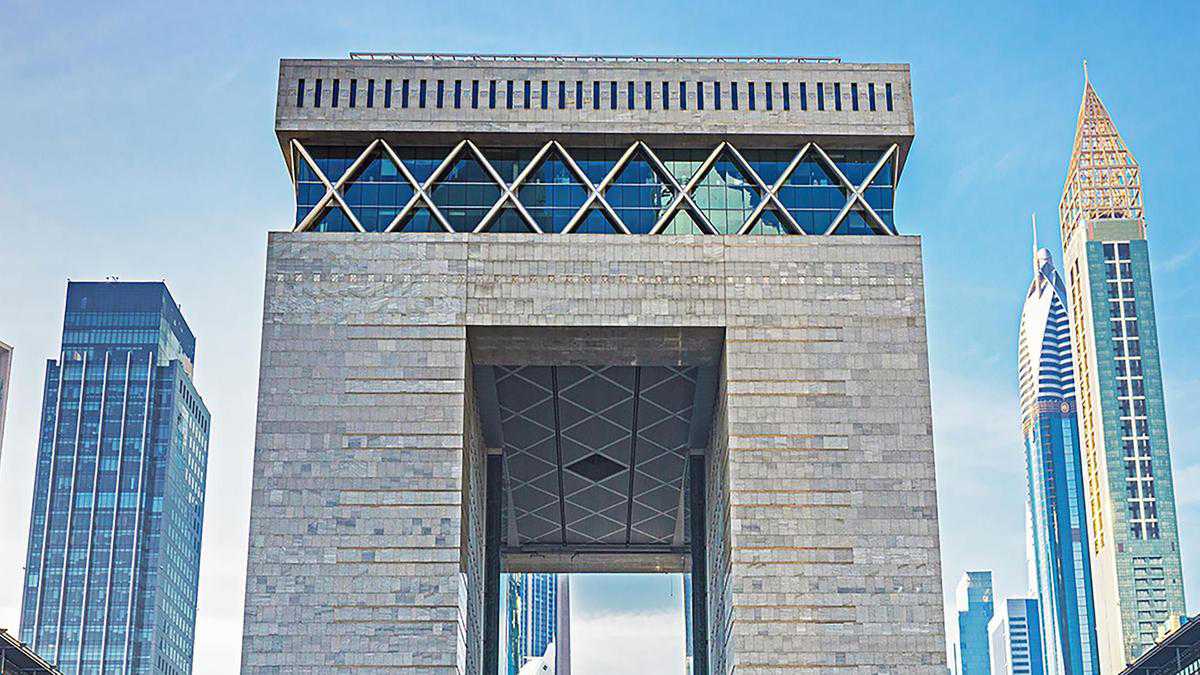

Ripple, a company that uses blockchain to increase digital payments, is opening a new regional headquarters at the Dubai International Financial Centre.

The US-based company said it chose the centre as its Middle East and North Africa base because of its innovative regulations and reputation as a respected financial centre.

“Ripple is among the most exciting client additions to DIFC this season. They are well-regarded globally for innovation in the finance industry and for that reason is an ideal partner and client for DIFC,” said DIFC Authority leader Arif Amiri.

“Together, we will advance the utilization of blockchain in Dubai, UAE and the region, and accelerate the Emirates Blockchain Strategy 2021.”

Ripple is a FinTech company in SAN FRANCISCO BAY AREA that created the world's third-most actively traded cryptocurrency, which originally shared the same name but has been rebranded as XRP.

Ripple still holds billions of dollars of XRP tokens, that have appreciated in value by 38 per cent since the start of year to $0.26412 on Saturday, in line with the Bitstamp exchange, giving the cryptocurrency market capitalisation of just over $12 billion.

The business, however, has increasingly centered on working with governments, banks and other organisations to try to replace a number of the older systems which exist between networks of correspondent banks for cross-border payments with an easier system predicated on blockchain.

In the centre East, it has signed handles the Saudi Arabian Monetary Authority, Saudi Arabia's central bank, allowing banks to use its technology, with UAE-based lender RAKBank and with forex company UAE Exchange.

The Central Bank of the UAE unveiled new rules governing placed value facilities in an effort to raise the country's digital payment services the other day.

The UAE's banking regulator said that through the brand new regulations, it aims to facilitate easier market usage of FinTech companies and other non-bank payment providers while making certain customers' funds are safe.

Source: www.thenationalnews.com

TAG(s):