Foreign funds fall further in DSE

02 July, 2018

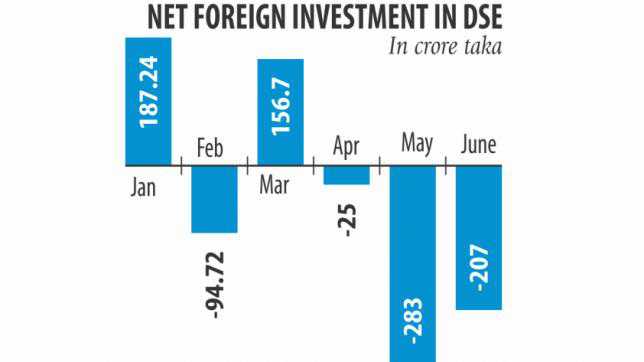

Net foreign investment in the Dhaka Stock Exchange fell to Tk 207 crore in the negative in June because of fears over political uncertainty in the run up to national election at the year-end.

Foreign investors bought shares worth Tk 446 crore and sold securities worth Tk 653 crore, according to data from the premier bourse.

The net foreign investment plummeted to Tk 283 crore in the negative in May and Tk 25 crore in April.

“Fears of political uncertainty prompted foreign investors to go for sell-offs,” said a merchant banker requesting anonymity.

He said the depreciation of the local currency against the US dollar also contributed to the sell-off by the foreign investors.

When the taka depreciates, foreign investors will have to make more profit to offset the loss induced by the exchange rate volatility.

For instance, if foreign investors had made Tk 80 profit seven months ago they would have been able to take home $1. But at the moment, they will have to make a profit of Tk 83.70 to take home the same USD as the taka has depreciated.

Moreover, foreigners are concerned about the future of the economy as it had suffered during the parliamentary election in the past because of polls-related unrest.

“So, foreign investors are offloading their portfolio,” said another merchant banker.

The sell-off has led to a decline in the share prices of the blue chip securities as the high-quality issues are often the main attraction of the foreign investors.

Institutional investors are buying these shares, helping the turnover of the market soar. The benchmark index, however, has remained almost the same in June.