Japan's Suzuki: Gradual yen fall, not just volatile moves, a concern

02 November, 2022

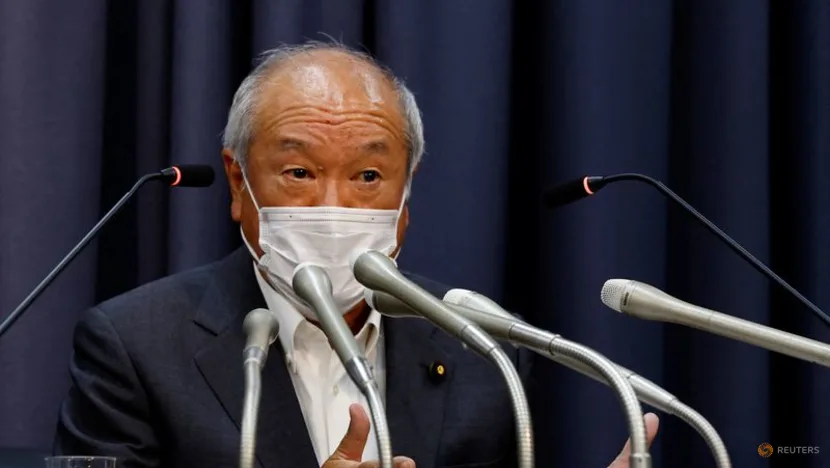

Japan is concerned not just about excessive yen weakening but also a slow depreciation in the Japanese currency as it boosts living costs through higher import bills, Finance Minster Shunichi Suzuki said on Wednesday.

Suzuki's comment highlighted policymakers' concern about the negative impacts of a weaker currency on a fragile economic recovery from the COVID-19 pandemic.

"What we should bear in mind is surging import prices caused by a weak yen (are) raising inflation," Suzuki told a parliament session. "In that sense, stable or gradual yen weakening is a great source of concern." Suzuki did not elaborate but his comment may signal a change in the government's stance of focusing on the velocity of yen moves in responding to the foreign exchange market.

The government spent a record $43 billion supporting the yen last month after it slumped to a 32-year low. In September, it conducted its first yen-buying intervention since 1998.

Suzuki also said that currency rates should be determined by markets, while being affected by various factors.

Suzuki added that Japan must stick to fiscal discipline so as to not lose market confidence in the yen currency.

The world's No.3 economy rebounded firmly in April-June backed by consumer and business spending due to a pullback from COVID curbs, but a slowdown in China and other economies and cost-push inflation driven by a weak yen are clouding the outlook.

Useful Links:

Source: www.channelnewsasia.com