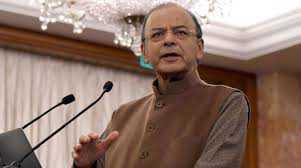

GST not disruptive, higher revenues to aid rate rationalisation: Jaitley

02 July, 2018

Union Minister Arun Jaitley on Sunday said rollout the Goods and Services Tax (GST) has not been disruptive in the last one year and exuded confidence that higher revenue collections would enhance the capacity of the Government to rationalise tax rates going forward.

Speaking on the occasion of the first anniversary of the GST rollout, the Minister stressed that the best in terms of the impact of new tax regime on the GDP growth, ease of doing business, expansion of trade and industry, Make in India initiative and promoting honest business practices was yet to come.

He also dismissed the idea of a single rate GST being advocated by Congress President Rahul Gandhi as “flawed” saying that it can only work in a country where the entire population has ‘similar and high’ capacity to spend.

Jaitley, who is recuperating from a kidney transplant, joined the ‘GST-Day’ celebrations through video conferencing.

GST which subsumed 17 local taxes was rolled out on July 1, last year. Currently over 1.14 crore businesses are registered under the new tax regime.

Observing that countries implementing GST had witnessed major disruption, Jaitley said he too had felt that it would cause disruption in the Indian economy.

“I myself used to use the word disruptive when it came to major reform like GST because it takes time to settle down. But after one year of experience I’m not too sure whether I can use the word disruptive for GST reform. The smooth manner in which the changeover has taken place is almost unprecedented anywhere in the world,” Jaitley said.

He said the the economy has seen “effective gains” of GST roll out in the last year. “...The best of GST, in terms of its contribution to society, is yet to come,” Jaitley said.

In the current fiscal, mop up from GST topped Rs 1.03 lakh crore in April, Rs 94,016 crore in May and Rs 95,610 crore in June.

“As the tax collection goes up, the capacity to rationalise the slabs, the capacity to rationalise the rates, also will certainly increase. And therefore that capacity to rationalise will increase once the total volume of tax collected significantly increases,” Jaitley said.

Stating that the input tax credit itself is an effective route for ensuring that people make their disclosures faster, Jaitley said once you have a more efficient tax system it will ensure that evasion does not take place.

“The e-way bill has already been implemented and once the invoice matching comes in, evasion and detection of evasion itself will become far simpler itself,” he said.

In an article titled ‘The GST Experience’ on completion of first year of the roll out of the new indirect tax regime, he said the key areas of future action will include further simplifying and rationalising the rate structure and bringing more products into the GST. “I am confident that once revenue stabilises and the GST settles, the GST Council will look into these carefully and act judiciously.”

He said since GST is a regressive tax, the poor have to be given a substantial relief, he said, stressing that most food items – agricultural products and the Aam Aadmi products have to be tax exempt while some others have to be taxed at a nominal rate.

“Rahul Gandhi has been advocating a single slab GST for India. It is a flawed idea. A single slab GST can function only in those countries where the entire population has a similar and a higher level of paying capacity.

“Being fascinated by the Singapore model is understandable but the population profile of a state like Singapore and India is very different. Singapore can charge 7 per cent GST on food and 7 per cent on luxury goods. Will that model work for India?,” the minister questioned. Jaitley, who was the Finance Minister when the GST was introduced, is currently minister without portfolio.

Addressing through the video conferencing, he said the goods which are currently in the 28 per cent tax bracket, were taxed at 31-32 per cent in the pre-GST era because of the cascading effect of various taxes.