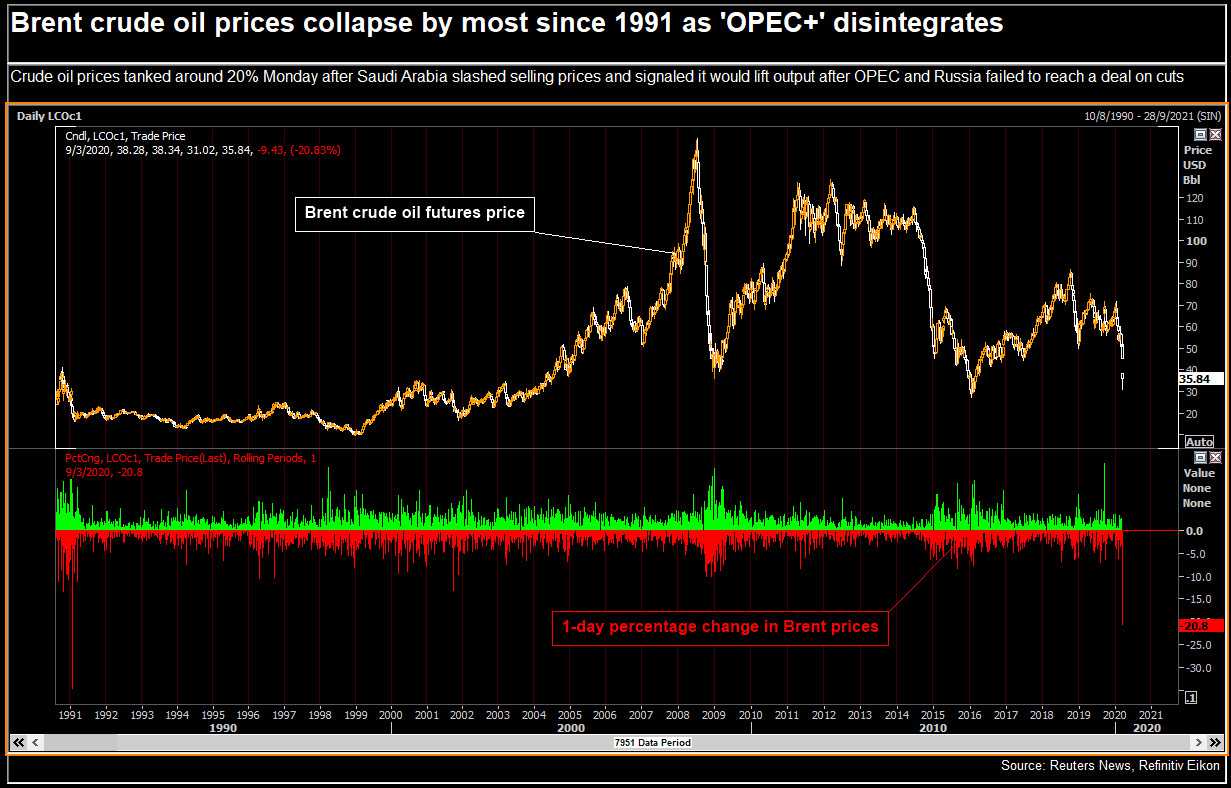

Oil slumps to lowest since 2003 about global recession threat

18 March, 2020

Oil briefly traded below its lowest settlement selling price on almost 17 years as the coronavirus pandemic threatens to bring the global economy to a standstill, battering demand only as supply explodes.

Futures in NY fell just as much as 2.8 percent in the Asian morning, touching only $26.20 a barrel, which will be the lowest settlement selling price since May 2003. Rates clawed back some of their preliminary losses but remain a lot more than 15 percent weaker this week in the virtually all volatile trading on record.

While policymakers around the world have unprecedented techniques to shore up their economies from the fallout of the coronavirus, the meltdown in oil demand and concurrent source free-for-all by the world’s biggest producers continue to pull crude prices ever lower.

“I don’t think we have hit peak demand devastation yet,” said Stephen Innes, Asia Pacific industry strategist at AxiCorp, who predicts oil may fall to $18-$20 a barrel. “If cases exponentially increase, especially in america, its going to spook the hell out of oil dealers.”

The marketplace is finding little succor in global efforts to stem the monetary fallout. The U.S. Government Reserve on Tuesday released the restart of a personal crisis-era program in order to stem the economic influence from the virus. While US stocks rebounded from the biggest rout since 1987 on the program, oil continued its slide as Saudi Arabia signaled its purpose to ship an archive 10 million barrels a day in April.

The source and demand shocks have hammered Wall Street’s outlook for oil. Goldman Sachs Group Inc. said consumption is straight down by 8 million barrels a day and lower its Brent forecast for the next quarter to $20 a barrel. On the other hand, Mizuho Securities warned crude rates could go unfavorable as Russia and Saudi Arabia flood the marketplace with supply.

West Texas Intermediate for April delivery was 2 cents lower at $26.93 a barrel on the brand new York Mercantile Exchange by 8:46 a.m. in Singapore. Brent crude added 7 cents to $28.80 after slumping 4.4% on Tuesday.

Source: www.thejakartapost.com

TAG(s):