Private banks made to work harder for deposits

14 July, 2018

Despite intense efforts to attract funds private banks are experiencing a slowdown in deposit growth due to a lack of confidence of depositors following a series of reports of loan scams.

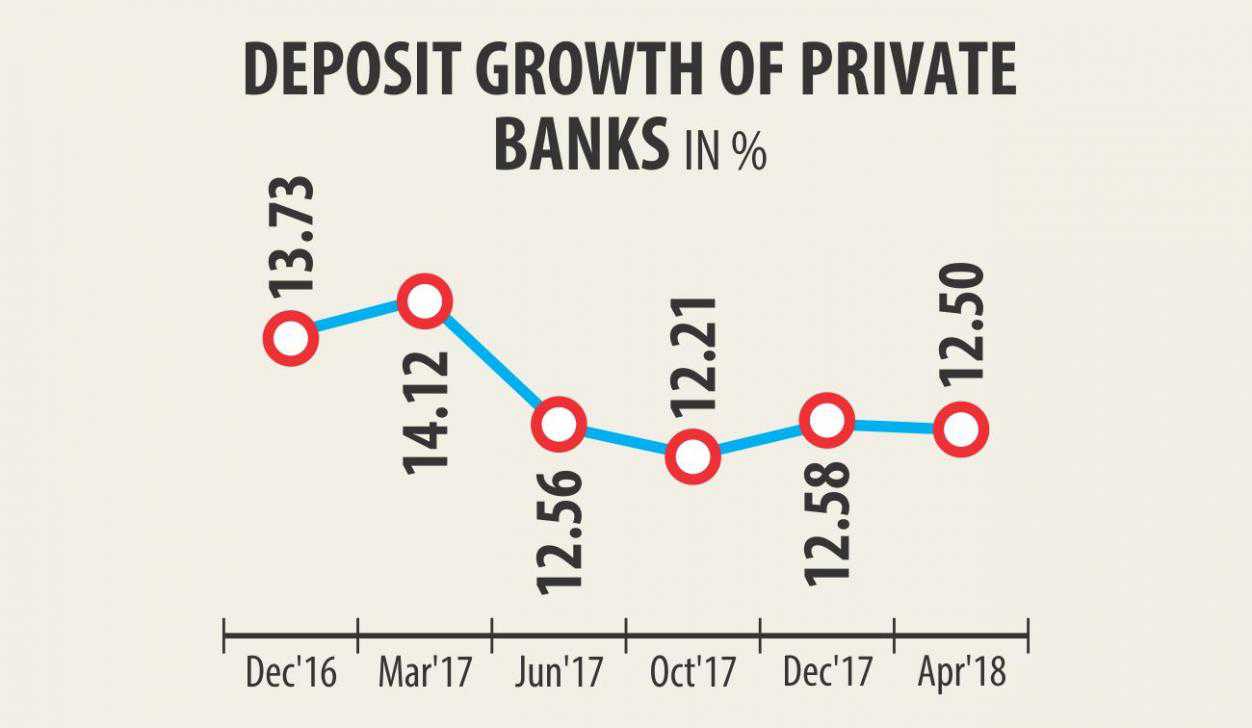

The deposit growth of private banks dropped to 12.50 percent in April from 12.58 percent in December last year, according to data from the Bangladesh Bank.

However, the total deposit growth in the industry crept up to 10.91 percent from 10.62 percent during the period, suggesting greater confidence in state banks amongst the depositors.

In the first four months of the year, state banks saw their deposit growth accelerate to 8.45 percent from 6.46 percent in December last year.

Various loan scams, especially the ones at Farmers Bank, eroded the confidence of depositors in private banks, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh (ABB), a forum of banks' chief executives and managing directors.

“People are giving preference to state banks for parking their funds.”

As a result, private banks are short of deposits despite offering higher interest rates than to state banks, said Rahman, also the managing director of Dhaka Bank.

The high interest rate of savings instruments is also discouraging people from depositing money with banks.

To exacerbate matters, the recent announcement of reducing the interest rate on deposits to 6 percent has prompted depositors to withdraw their funds from banks.

“There is long queue in banks and the Bangladesh Bank premises for buying savings instruments since the announcement came,” he added.

Earlier on June 20, the Bangladesh Association of Banks, a platform of private banks' directors, announced cutting the interest rate on deposits to 6 percent and on lending to 9 percent from July 1.

Among the private banks, the scam-hit Farmers Bank and AB Bank are in severe crisis of deposits.

Farmers Bank, which could not return depositors money due to severe cash crisis, saw a negative growth in deposits.

At the end of April, its deposit growth stood at 9.25 percent in the negative in contrast to 5.52 percent in the negative in December last year.

The total deposit of the bank stood at Tk 4,420 crore in April against the loan portfolio of Tk 5,161 crore, according to central bank data. The bank is offering interest rate of 8.56 percent on deposits and 13.35 percent on lending.

AB Bank is also in acute fund crisis, with its deposit growth in the first four months of the year being a mere 0.06 percent. However, the growth was 1.93 percent in the negative in December last year.

In May, the bank was paying 7.2 percent interest against deposits and taking 11.73 percent against loans.

The weighted average interest rate of state banks was 8.01 percent as of April.

At the end of April, the total deposit of the banking sector stood at Tk 10,17,200 crore, of which private banks accounted for 66.19 percent of the sum.

TAG(s):