Sony sees software subscription as future for data-analyzing image sensors

01 July, 2020

Sony Corp's photograph sensor business aims to replicate PlayStation's success to address its reliance on a small number of manufacturers in the fickle smartphone industry: It plans to sell software by registration for data-analyzing sensors found in situ.

Transforming the light-converting chips into a platform for software - essentially comparable to the PlayStation Furthermore video games program - amounts to a sea change for the $10 billion organization, which made its dominance through hardware breakthroughs.

The effort chimes with Sony's quest for recurring earnings after years of loss in the volatile gadgets sector. Success, analysts stated, could serve as a rejoinder to activist trader Daniel Loeb's demands the business to come to be spun off.

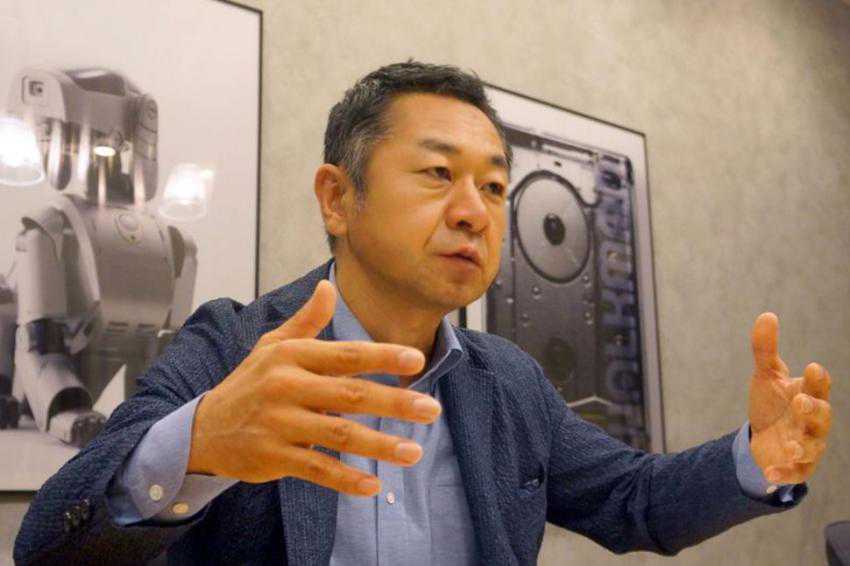

"We have a good position in the market for photograph sensors, which serve as a gateway for imaging data," stated Sony's Hideki Somemiya, who heads a fresh team growing sensor applications.

Analysis of such data with artificial intelligence (AI) "would form market bigger than the growth potential of the sensor market itself with regards to value," Somemiya said within an interview, pointing to the recurring dynamics of software-dependent data processing versus a hardware-only business.

Sony has developed what it calls the world's first photograph sensor with integrated AI processor chip. The sensor can be installed in security camera systems where it can select factory workers certainly not wearing helmets, for example, or be mounted in vehicles to monitor driver drowsiness. Significantly, the software can be modified or substituted wirelessly without disturbing the surveillance camera.

The Japanese conglomerate hopes customers will subscribe to its sensor software service through monthly service fees or licensing, very much like how gamers buy a PlayStation console and purchase software or sign up to online services.

Sony hasn't disclosed a start time for the service, but at a news meeting last month, Somemiya said there is demand from "retailers, factories - mainly business-to-business".

South Korea's Samsung Consumer electronics Co Ltd and Chinese-owned OmniVision Systems are likewise expanding the software capability of image sensors, but analysts said a 52% market share presents Sony a competitive advantage in the emerging region.

Even now, said Somemiya, a software-centered approach will demand a change of mindset in a division familiar with abiding by technical specs of smartphone makers - only five of whom take into account the bulk of its revenue.

The brand new direction comes as U.S. hedge fund Third Level LLC, a minority investor headed by Loeb, proceeds to drive Sony to spin off the photo sensor division, declaring its value could possibly be higher if it was certainly not masked by the complexity of the company.

Sony LEADER Kenichiro Yoshida counters that keeping the division internal gives it easier access to group resources and has said diversity may be the company's strength.

"CEO Yoshida's communication suggests Sony will give attention to profit expansion with diversified businesses," said analyst Junya Ayada in JPMorgan Securities.

Sony's portfolio may be growing found in complexity, but it still reported two consecutive years of record earnings through March 2019, Ayada said.

Having technology with diversified applications can even be advantageous in instances of uncertainty, stated Atsushi Osanai, professor by Waseda University Organization School.

"The next big issue for sensors may be in self-traveling technology, but it is critical to explore various other applications," Osanai said.

Even now, others said it really is hard to factor in the potential of the sensor software subscription service as it could take years for such a organization to become a driver of Sony's overall development.

"The amount of sensors employed at factories and retailers will probably be small in comparison to those for the over one-billion-unit smartphone industry," explained analyst Hideki Yasuda at Ace Securities.

Source: japantoday.com

TAG(s):