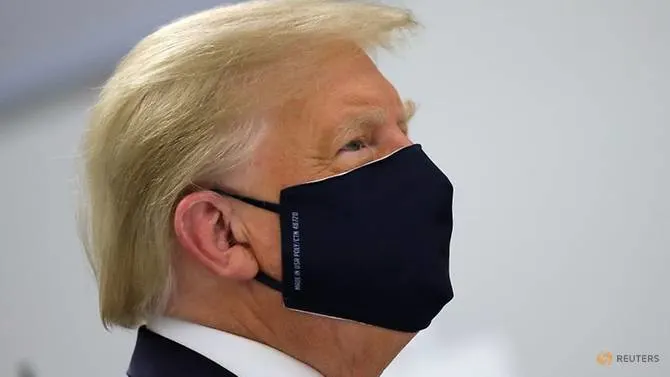

Stocks rise as signs of Trump's bettering health calm markets

05 October, 2020

Stock markets rose on Monday (Oct 5) on hopes that President Donald Trump could possibly be discharged from hospital later in the day, easing a number of the political uncertainty that shook global bourses in the last session.

Trump, 74, was flown to hospital for treatment for the coronavirus on Friday, but his doctors say he has responded well and may go back to the White House on Monday.

That helped US S&P 500 e-mini futures rise 0.82 % in Asian trading, while Nasdaq futures gained 1.11 per cent.

MSCI's broadest index of Asia-Pacific shares outside Japan rose 0.63 per cent.

Australian stocks jumped 2.37 per cent for the biggest daily gain in almost fourteen days. Japan's Nikkei rose 1.39 per cent. China's financial markets are closed for a public holiday.

"Equities and other risk-on traders ought to be well supported by easing concerns about Trump's health," said Junichi Ishikawa, senior currency strategist at IG Securities in Tokyo.

"For the dollar, the impact isn't quite as clear cut. It will fall against most currencies due to a rise in risk appetite, but the yen can be weak, and that's the one currency the dollar can rise against."

The dollar edged higher against the yen but fell slightly against the Swiss franc as traders jockeyed for position ahead of what is actually a volatile day in global markets.

Treasury yields rose slightly on reduced demand for the safety of holding government debt.

Doctors treating Trump say they are pleased with his progress. Relief about his health could fuel a rally in equities and other risky assets as investors prepare for the run-up to next month's US presidential election.

Investors around the world were stunned late Thursday after Trump announced that he and the first lady had tested positive for coronavirus.

With less than a month before presidential election on Nov 3, Trump's contraction of the coronavirus is another way to obtain market volatility which makes the results of the vote even more difficult to predict.

Democrat Joe Biden opened his widest lead in per month in america presidential race, according to a Reuters/Ipsos poll released on Sunday.

The White House primarily sent mixed messages about Trump's health, helping fuel political uncertainty and putting the investor focus tightly on any news about his condition.

Some traders were particularly concerned by doctors' admission that Trump had received supplementary oxygen and steroids, which are usually used to treat extreme cases of COVID-19.

THE UNITED STATES dollar rose 0.22 per cent to 105.60 yen but fell 0.3 % to 0.9185 Swiss franc as some investors adjusted positions in safe-harbour currencies.

The Australian dollar rose 0.23 % to $0.7181 following the Australian government, which hands down a federal budget on Tuesday, announced additional wage subsidies to help the labour market.

Yields on benchmark 10-year Treasuries rose to 0.7104 % and the yield curve steepened slightly in an indicator that most investors felt comfortable dealing with more risk.

Gold, another asset often bought during times of uncertainty, was little changed at $1,898.90

Brent crude futures rose 1.22 per cent to $39.75 a barrel while US crude futures gained 1.46 % to $37.59 per barrel.

Source: www.channelnewsasia.com