Takeover of GKN presents challenge to Government's industrial policy

Nothing like a good political controversy over a big corporate takeover battle to liven up the new year, and the tilt at engineering giant GKN taken by investment outfit Melrose is certainly whipping one up.

First, the background: GKN is a FTSE-100 listed multinational that designs and makes components and systems for aircraft, cars and machinery.

It has been under a bit of a cloud since October, when it admitted that troubles at its US aerospace arm would force it to take a large write down and hamper profit growth. This has inevitably led to speculation about a potential bid and/or a break-up.

In the meantime, GKN has installed a new management team led by Anne Stevens, whose CV contains names like Ford and Lockheed Martin and who knows a thing or two about turnarounds.

She’s put together a new strategy that will see the business split into two units under one holding company, with a promise to boost earnings in both. The question is whether she’ll get the chance to put it into effect.

Melrose thinks it can do a better job. It’s first approach – at £7bn – has been resoundingly rejected, but most observers expect it to come back before too long.

Melrose is one of those spectacularly successful business that have made pots of money without anyone outside of the City ever having heard of them. It has done this by buying up struggling manufacturing businesses, sorting them out and selling them on.

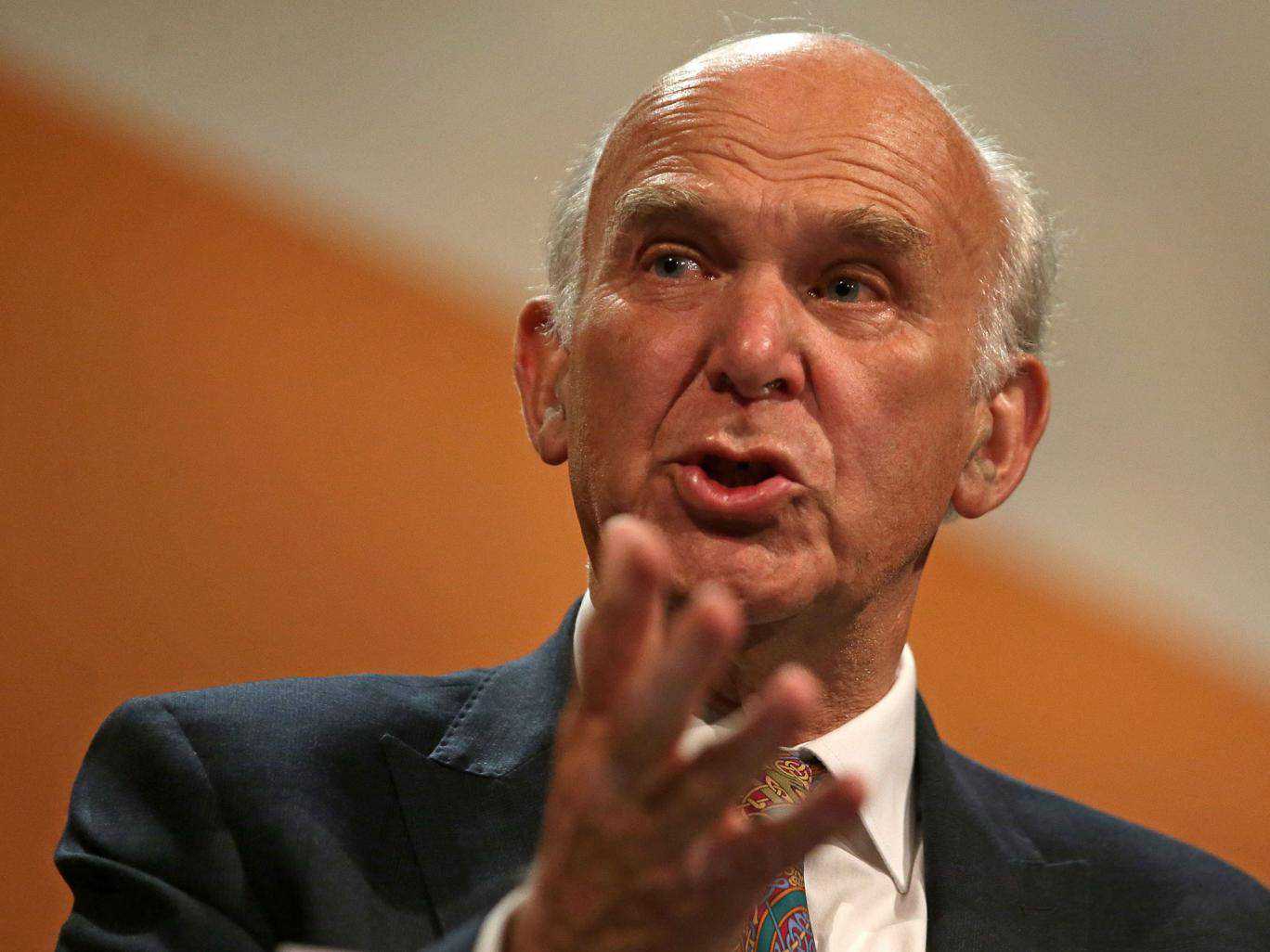

The controversy comes through Liberal Democrat leader Sir Vince Cable, who has contrasted GKN the engineer with Melrose, which he describes as a financial engineer.

It matters because GKN employs 6,000 people in the UK at 14 sites, out of a global workforce of 58,000. If the Government’s much-vaunted industrial strategy is to be successful, a company like GKN could be expected to play a highly important role.

The businesses Melrose takes out only remain in its ownership for a relatively short time (three to five years is quoted) and there are two debates to be had about its interest.

The easiest one to resolve is about whether it’s good for shareholders. GKN has a credible CEO in Ms Stevens, and she has put forward a credible plan. Melrose’s interest has been sparked by weakness in the share price caused by the US issue, and that might prove to be temporary.

However, at some point every company has its price. The question is whether Melrose’s estimation of GKN’s medium- to long-term worth ultimately matches that of its shareholders.