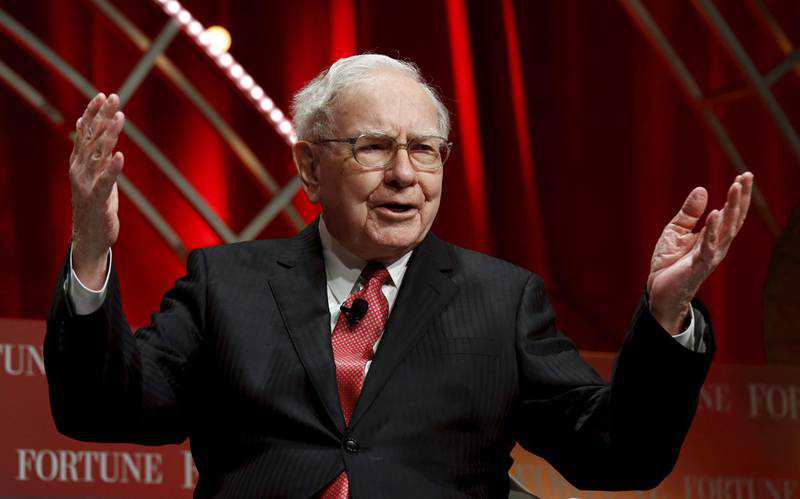

Billionaires: Warren Buffett's net worth surges to $125bn

21 March, 2022

In our fortnightly roundup, Melinda French Gates and MacKenzie Scott back the $1bn Gender Fund and e-commerce tycoon Sachin Bansal’s Navi files for a $442m listing

Warren Buffett is back among the richest five people in the world amid steep drops in technology stocks that are eroding the wealth of Silicon Valley executives.

Mr Buffett’s fortune has grown 14.8 per cent this year to $125 billion as Berkshire Hathaway shares have rallied, putting him in fifth place on the Bloomberg Billionaires Index.

Over the same period, technology billionaires such as Tesla's Elon Musk and Amazon’s Jeff Bezos have seen their net worth drop by 17.3 per cent and 5.4 per cent respectively.

It is the first time in a year that Mr Buffett, 91, has ranked this high among the listing of the world’s 500 richest people. He fell as low as 11th in October.

Investors have dumped technology stocks in recent weeks. US stocks overall fell the most in 17 months as Russia’s invasion of Ukraine has prompted fears of prolonged oil shortages and accelerating inflation.

Last week, Berkshire Hathaway disclosed a purchase of about 30 million additional shares in Occidental Petroleum, a Houston-based oil and gas company. The deal, worth about $1.6b, helped to draw down the company’s near-record $146.7bn pile of cash.

Melinda French Gates and MacKenzie Scott

Billionaires Melinda French Gates and MacKenzie Scott are among philanthropists donating money to the Gender Fund, which seeks to raise $1bn to advance equality and women’s leadership in Africa, Asia and Latin America.

Contributions to date have topped $320 million and grant-making has begun across the three regions, Co-Impact, the fund’s manager, said. It plans to raise the target amount over the next 10 years.

While funding for gender equality has increased over the past decade, only 1 per cent of the total has actually reached women groups, the fund said. The new investment vehicle will provide large, long-term and flexible funding to predominantly women-led local organisations.

“It starts with opening more doors for women to step into their power and craft policies that lift others up like them,” Ms French Gates, co-founder of the Bill and Melinda Gates Foundation, said. “This is our once-in-a-generation chance to rebuild our systems to finally work for women and girls.”

Foundation, The Estee Lauder Companies Charitable Foundation and The Rockefeller Foundation.

The fund began sourcing and awarding an initial set of 15 grants for initiatives addressing issues, including gender-based violence, maternal health, gender inclusive education and women’s leadership.

About 2.4 billion adult women globally do not have access to equal opportunities and those working are paid only two thirds of what men are expected to earn, according to the World Bank’s Women, Business and the Law 2021 report.

Navi Technologies, the FinTech start-up founded by technology billionaire Sachin Bansal, has filed initial documents for a 33.5bn rupee ($442m) initial share sale, signalling that India’s technology start-up industry has not fully lost its initial public offering momentum.

Navi’s IPO will consist entirely of new shares, according to its draft prospectus, meaning that all proceeds will be ploughed directly back into the company.

The company may consider a pre-IPO placement of up to 6.7bn rupees, reducing the size of the main offering, according to the draft filing. The share sale may open in June, Indian news wire PTI reported.

The start-up, which markets personal and home loans, health insurance and mutual funds to India’s digitally connected middle class, has avoided moving into digital payments, a segment where several start-ups are struggling to become profitable.

Mr Bansal, 40, whose net worth surpassed $1bn when he sold his first start-up, online retailer Flipkart Online Services to Walmart, founded Navi at the end of 2018 with fellow entrepreneur Ankit Agarwal.

Navi’s revenue was about 7.2bn rupees for the nine months ended December, according to its filing, compared with 7.8bn rupees for the full fiscal year ending last March.

Navi’s lending app provides loans of up to 2m rupees instantly and digitally without any paper documents, according to its website. Its application to receive a banking licence is still pending with India’s banking regulator.

Masayoshi Son

Masayoshi Son, SoftBank Group's billionaire founder, checks the chart. Then again. Another time. And once more for good measure. Lately it has only moved in one direction: up.

It is not a chart of the firm’s stock picks. Those are sinking fast. So too is Mr Son’s fortune — at $13.7bn, it has crashed $25bn in the past year, according to the Bloomberg Billionaires Index.

The chart is SoftBank’s loan-to-value ratio, which Mr Son says he checks four times a day. It is key to how he staged his comeback over the past two decades after losing $70bn during the dot-com crash.

Only last year, SoftBank was flying high, borrowing against its wildly lucrative stakes in technology investments such as Alibaba Group and ploughing the money into the promising upstarts of tomorrow. Even when there were epic failures — Wirecard or Greensill Capital — profits elsewhere buried the problem.

Recently though, problems just keep piling up.

From China’s technology clampdown to Russia’s invasion of Ukraine, inflation to the markets, a litany of troubles has beset Mr Son and his conglomerate.

The stock has tumbled about 60 per cent in the past year and the loan-to-value chart that Mr Son obsesses over daily keeps ticking higher, indicating SoftBank’s net debt is becoming unwieldy relative to the equity value of its holdings. Some market watchers are flagging the risk of margin calls.

“There is no good news in sight,” said Tomoaki Kawasaki, a senior analyst at Iwai Cosmo Securities. “If they are asked to increase collateral, it will mean investors have to be more cautious of the finance risks the company’s facing.”

Mr Son, 64, acknowledges these are difficult times. In February, he described SoftBank as being “in the middle of a winter storm” and announced a ¥1.55 trillion ($13bn) decline to ¥19.3tn in the net value of the company’s assets for the three months through December.

Since then, it has worsened. The market for new share sales, critical to SoftBank’s success, has dried up. Didi Global sank a record 44 per cent last week after the ride-hailing company suspended preparations for a Hong Kong listing.

In the latest sign that SoftBank is strapped for cash, its Vision Fund sold $1bn of shares in South Korean e-commerce company Coupang at a discount last week.

“The macro picture for SoftBank’s investments and prospect for listings are not looking good,” said Amir Anvarzadeh, a strategist for Japan equity at Asymmetric Advisers, who recommends betting against the stock.

The falling value of its investments, such as Alibaba, exposes the company to the risk of margin calls, he said.

Mr Son has explained to investors how he checks SoftBank’s loan-to-value ratio, or LTV, several times a day. The measure, calculated by dividing its net debt by the equity value of its holdings, jumped to 22 per cent at the end of last year, from 8.8 per cent in June 2020.

The conglomerate aims to keep the ratio under 25 per cent. But an increase in borrowing, along with declines in Alibaba and SoftBank shares, have pushed it even higher this year.

S&P Global Ratings — which, unlike SoftBank, includes margin loans in its LTV calculation — estimated the ratio at 29 per cent on a March 7 call, according to Bloomberg Intelligence senior credit analyst Sharon Chen. If it exceeds 40 per cent, that could trigger a potential downgrade from the current "BB+" rating.

The Japanese company depends on financing to maintain its investment pace and support its share buyback programme. It will need as much as $45bn in cash this year and will probably sell Alibaba shares to meet the demands, Jefferies analyst Atul Goyal predicted last month.

Mr Son’s financing web goes beyond the core company. He has some of the biggest personal loans tied to company stock on the planet after pledging shares worth $5.7bn to 18 lenders including Bank Julius Baer, Mizuho Bank and the Daiwa Securities Group.

A SoftBank representative said the company does not comment on Mr Son’s personal finances.

Source: www.thenationalnews.com

TAG(s):