World Bank rejects El Salvador Bitcoin implementation request on environment and transparency concerns

17 June, 2021

The World Bank said on Wednesday it could not assist El Salvador's Bitcoin implementation given environmental and transparency drawbacks.

"We are committed to helping El Salvador in various ways including for currency transparency and regulatory processes," a global Bank spokesperson said in an email.

"As the government did approach us for assistance on Bitcoin, this is simply not something the World Bank can support given environmentally friendly and transparency shortcomings."

Earlier on Wednesday, Salvadoran Finance Minister Alejandro Zelaya said the Central American country had sought technical assistance from the World Bank since it seeks to use bitcoin as a parallel legal tender alongside the US dollar.

El Salvador's government did not immediately respond to a request regarding the World Bank's decision.

The minister also said ongoing negotiations with the International Monetary Fund have been successful, although the IMF said last week it saw "macroeconomic, financial and legal issues" with the country's adoption of Bitcoin.

Mr Zelaya said on Wednesday the IMF was "not against" the Bitcoin implementation. The IMF did not respond to a request for comment.

Investors have recently demanded higher premiums to carry Salvadoran debt, on growing concerns over the completion of the IMF deal, key to patching budget gaps through 2023.

On Wednesday, bonds sold off across the curve, with the 2032 issue down more than 2 cents at 96.25 cents on the dollar. The spread of Salvadoran debt to US Treasuries dipped to 705 basis points after hitting on Tuesday a four-month most of 725 bps.

"There is no fast track for a solution on an IMF programme and even uncertainty on if the Bitcoin proposal works with with diplomatic US (or) multilateral relations," said Siobhan Morden, head of Latin America fixed-income strategy at Amherst Pierpont Securities in New York.

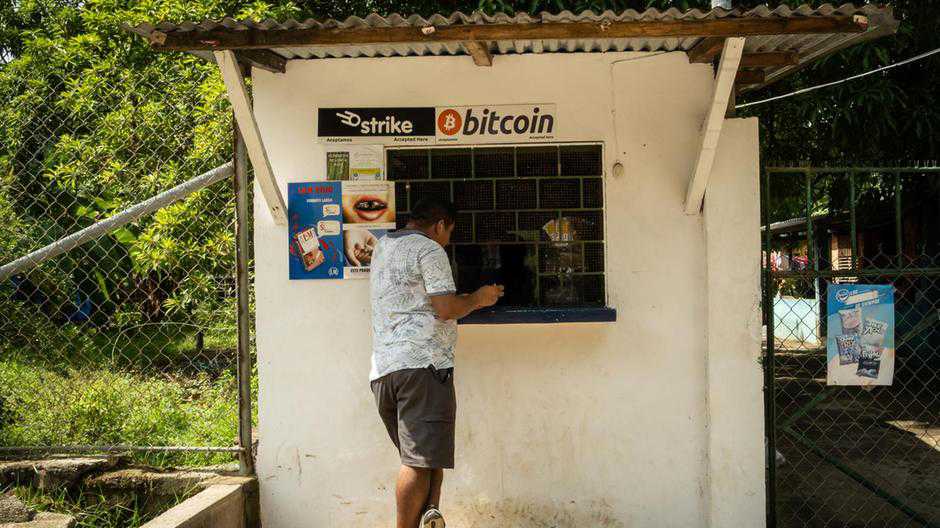

El Salvador this month became the first country to adopt Bitcoin as legal tender, with President Nayib Bukele touting the cryptocurrency's potential as a remittance currency for Salvadorans overseas.

This month, Mr Bukele also pulled out of an anticorruption accord with the Organization of American States, which dismayed the US government, as Washington looks to stem corruption in Central America within its immigration policy.

"The recognition of a 'Bukele' risk premium has probably done some long lasting harm to investor sentiment," Ms Morden said in her client note.

The market could be focusing too much on the news headlines, however, and not enough on the opportunity of a cope with the IMF, said Shamaila Khan, head of EM debt strategies at AllianceBernstein in New York.

"It is important for El Salvador to get the IMF programme done. If it was lost on them, they wouldn’t have the conversations," she said.

"Our view is an excessive amount of risk is priced in at these levels."

Source: www.thenationalnews.com

TAG(s):