Bangladesh outdoes China, Vietnam in apparel export growth in US

21 December, 2021

Bangladesh has outnumbered China, Vietnam and Indonesia in terms of growth in apparel exports to the United States in January-October this year, with many US buyers shifting orders to the supplier country from the three competitors that are going through production disruptions.

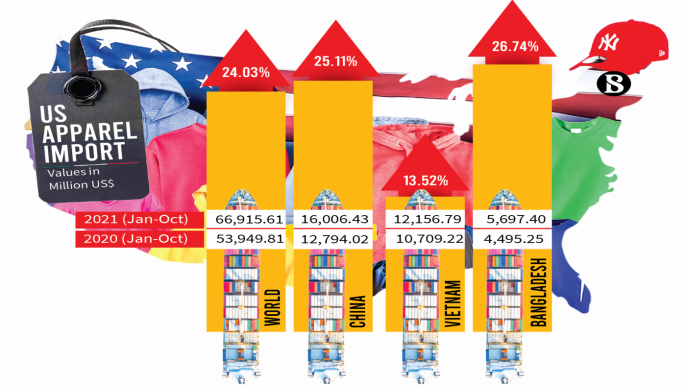

Bangladesh, which now ranks third in RMG exports to the US, fetched $5.7 billion from the destination in the first 10 months, up by around 27% from the receipts over the same period in 2020, according to the Office of Textiles and Apparel (Otexa).

China's exports to the US market amounted to $16 billion with a 25% growth, followed by Vietnam 14% and Indonesia 10%.

On the other hand, four out of six other top US suppliers have registered better growth than Bangladesh.

Industry insiders say Bangladesh apparel makers have been receiving an additional flow of work orders because of a drastic fall in China's factory outputs fuelled by energy shortages, and pandemic-led supply chain disruptions in Vietnam and Indonesia.

"Our apparel exports to the US market have kept growing with many US buyers now shifting to us," Mohammad Hatem, executive president of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), told The Business Standard.

Buyers' sourcing inquiry from the western country has further paced up. So, exports will go up all the more in the coming months, he said.

With the reboot of economic activities in the US after the pandemic situation turned the corner, Americans have started releasing pent-up demand, especially for clothing and footwear.

Dr Mohammad Abdur Razzaque, chairman of Research and Policy Integration for Development, said as the pandemic retreated, Americans with cash incentives from their government started spending on things, such as clothing, they were deprived of. So, the country's imports marked a sharp rise.

In January-October, the US imported nearly $67 billion worth of clothing items, which was 24% more than in the same time a year ago, Otexa data says.

China's apparel exports to the US might halve in the next five or 10 years, opening up an opportunity for Bangladesh to take a bigger stake in the largest market, Abdur Razzaque noted.

If Bangladesh takes production costs under control by making business easier, it will take an edge over Vietnam that is expected to put up a tough fight.

Md Shahidullah Azim, vice president of Bangladesh Garment Manufacturers and Exporters Association (BGMEA), told TBS, "We could have exported more to the US market. Because of high costs of doing business, many exporters do not take many orders despite having capacity as prices they are getting are not in line with production costs."

They demand more prices for products if raw material costs go up, but they cannot do so if production costs increase for other reasons, such as logistics, said Shahidullah, also the owner of Classic Fashion Concept Ltd.

Mohammad Hatem said Bangladesh's export growth in the US market is very good even after paying 16% duty.

At least if the country's cotton-made garments can be exported to that US market duty free, Bangladesh will see its exports increase significantly.

The top six garment exporters to the US market are India, Mexico, Honduras, Cambodia, Pakistan and Korea.

In the first 10 months this year, India, Mexico, Honduras and Pakistan registered higher export growth than Bangladesh although their exports were lower than Bangladesh's.

Source: www.tbsnews.net