Yellen clarifies she actually is not really predicting Fed rate increases

05 May, 2021

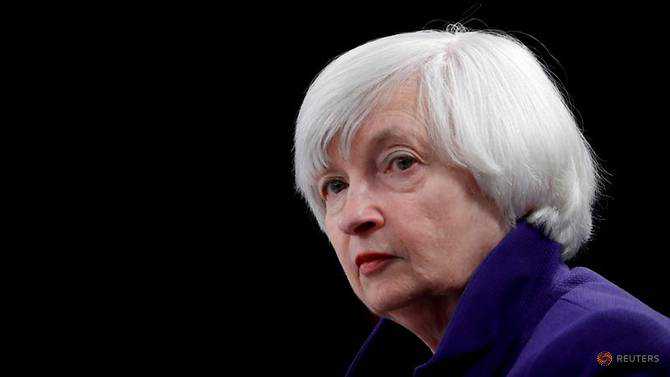

US Treasury Secretary Janet Yellen said on Tuesday (May 4) that she actually is not predicting when the Federal Reserve may need to start raising interest rates.

She was wanting to clarify her earlier remarks that rattled financial marketplaces.

Yellen suggested in early stages Tuesday that interest levels may need to surge slightly to keep the market from overheating. Those remarks directed stock rates down with the declines led by tech shares.

“It may be that interest costs must rise somewhat to make sure that our market doesn't overheat, even though the excess spending is relatively small in accordance with how big is the economy,” Yellen said in remarks webcast through the Atlantic's Future Overall economy Summit.

But later in your day, Yellen was first asked about the marketplace reaction to the remarks at another virtual meeting sponsored by the Wall Road Journal. She explained a rise in rates of interest "is not a thing that I am predicting or recommending".

Yellen, the first girl to head both Federal Reserve and the Treasury Section, said no one respects the Fed's independence a lot more than she does.

She said she actually is confident that the central bank will continue to work to attain its dual mandate of maximum work and stable prices.

Yellen said she expects any sort of upsurge in inflation will come to be transitory and not a sign that cost pressures will rise to worrisome levels. That is the same position placed by her successor at the Fed, Jerome Powell.

She said she didn't expect inflation problems to arise but if indeed they conduct, “the Fed can be counted on to address them”.

Source: www.channelnewsasia.com