Singapore’s income position to be 'weak' in coming years, spending strategy one of 'prudence, not austerity': DPM Heng

06 October, 2020

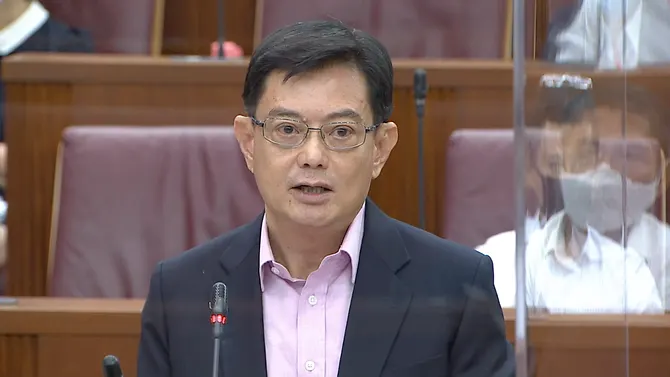

THE FEDERAL GOVERNMENT expects Singapore’s revenue position to stay weak for a number of years due to the impact of COVID-19 on the global and local economy, said Deputy Prime Minister Heng Swee Keat in Parliament on Monday (Oct 5).

At the same time, expenditure will rise as authorities continue steadily to provide support for residents and businesses, he noted.

"This challenging fiscal position is because a worldwide pandemic that no one could have predicted. What's in your control is how we use our fiscal resources well to react to this crisis and also to prepare for the near future," said Mr Heng.

Delivering his ministerial statement on Singapore's response to the COVID-19 crisis, Mr Heng said close to S$100 billion has been reserve for support measures.

He cautioned, however, that the united states should be mindful about just how it spends.

“We must take care not to spend in a manner that squanders what generations before us had painstakingly developed,” said Mr Heng who's also Finance Minister.

“Our guiding principle is prudence, not austerity. We will continue to invest decisively in our national priorities, with a deep commitment to leave behind a better future for our kids."

Mr Heng noted that the federal government is bearing a significant the main economy-wide adjustment in this crisis, as its revenues have fallen while it makes “substantial transfers” to households and businesses.

Revenue collection is expected to fall across all categories of revenue. For example, GST collections will probably fall by 14 % compared to estimates made in the beginning of the year, Mr Heng said.

New measures and extensions to many support initiatives were announced on Monday, plus they fall within the S$8 billion spending explained in August, said the minister, as the extra expenditure will be funded by reallocating money from areas where spending transpired, such as for example development projects which have been delayed because of COVID-19.

This means there is absolutely no additional draw from the reserves for the most recent round of measures, and the full total draw on the reserves remains within S$52 billion.

According to a statement from the Ministry of Finance, Singapore’s overall budget balance for FY2020 is projected going to a S$74.2 billion deficit.

Operating revenue is likely to be S$63.7 billion, which is S$5.1 billion - or 7.4 % - lower than the revised estimate presented at May’s Fortitude Budget, due mainly to a more subdued monetary growth environment due to COVID-19 and lower economical activity through the “circuit breaker” period, the finance ministry said.

And in comparison to estimates given at February’s Unity Budget, the operating earnings will likely can be found in at S$12.3 billion or 16.1 % lower than that which was initially calculated.

“We expect our income position to be weak for several years, as the consequences of COVID-19 on the global economy linger, and our economy slows,” Mr Heng said.

“Simultaneously, our expenditure will rise as we continue to provide support for our persons and businesses."

He stressed that much work should be done to develop Singapore’s economy and society. The united states will have to find methods to fund its growth sustainably through higher taxes and “more effective spending”, he said.

“These are difficult choices, but we should meet them head-on,” he said.

"We may also maintain a disciplined and judicious utilization of borrowing, reserving its use for long-term infrastructure whose benefits are spread across many generations."

Mr Heng warned that other countries’ governments have committed trillions of dollars in response to COVID-19, and their debt levels have risen to record highs, which will take “generations to repay”.

“We've avoided this outcome, because successive generations have developed strong reserves ahead of this crisis,” he said.

“We must have the discipline to start out earning, saving, and investing for future years again,” he added. “COVID-19 isn't our first crisis, and certainly will not be the last.”

Source: www.channelnewsasia.com