Abu Dhabi's Advantage among world's 25 biggest military suppliers

08 December, 2020

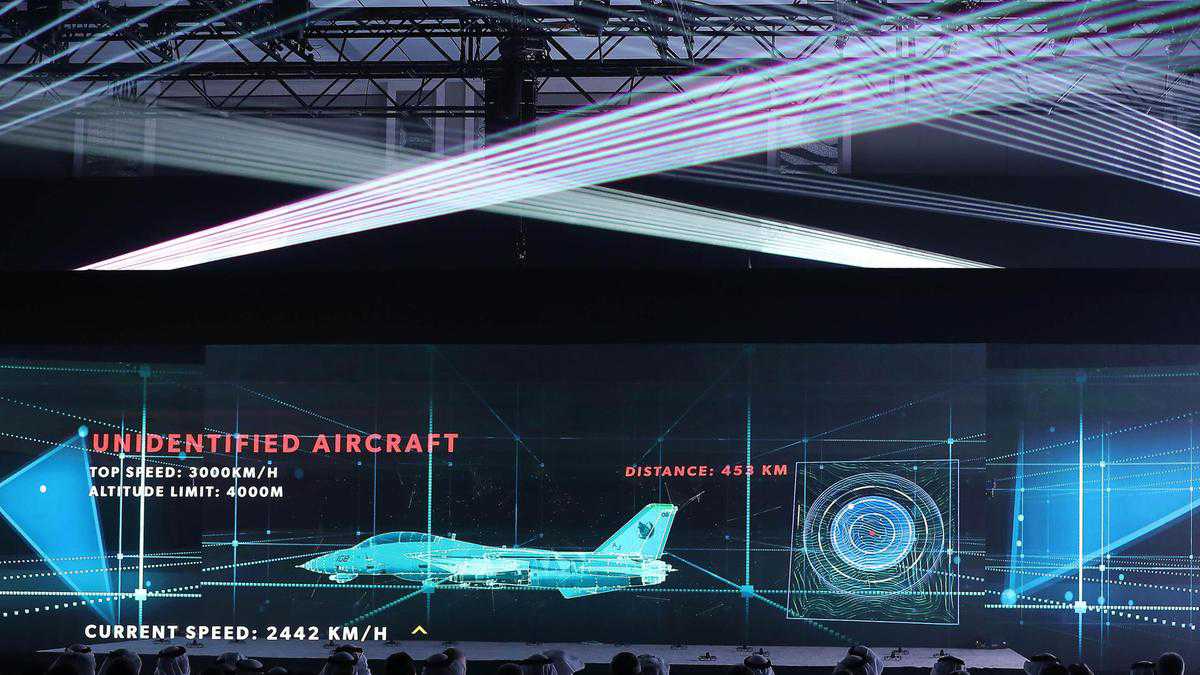

Abu Dhabi’s defence group Advantage has become the first enterprise from the center East to rank in the most notable 25 companies worldwide for global product sales of military products and solutions, according to new info.

Edge, which was created through the merger of more than 25 smaller businesses last year, is now the 22nd-biggest company on the globe with regards to domestic and foreign hands product sales, the Stockholm International Peace Study Institute (Sipri) said.

“Edge is an effective illustration of how the combination of superior national demand for army products and services with a good desire to become less dependent on foreign suppliers is traveling the growth of hands companies in the centre East,” Pieter Wezeman, senior researcher of Sipri’s Hands and Military Expenditure Program, said.

The data from Sipri’s Arms Sector Database showed sales by the defence industry’s 25 biggest companies rose by 8.5 per cent this past year to $361 billion.

The most notable five arms companies globally are located in the US - Lockheed Martin, Boeing, Northrop Grumman, Raytheon and General Dynamics. Between them, they produced $166bn in twelve-monthly sales.

Some 12 of the most notable 25 companies in the rankings were from the US, accounting for 61 % of the $361bn made by the most notable 25. Four Chinese firms made the ratings - three of which were in the very best 10. Aviation Industry Company of China rated sixth, China Electronics Technology Group Corporation was eighth and China North Sectors Group Corporation, or Norinco, was ninth.

Chinese arms companies’ sales grew 4.8 % and “are actually benefitting from military modernisation programmes for the People’s Liberation Army”, Sipri senior researcher Nan Tian stated. Chinese defence companies made 16 per cent of the most notable 25’s combined sales.

The revenues of the two Russian companies in the most notable 25 - Almaz-Antey and United Shipbuilding - decreased by a combined $634 million between 2018 and 2019, Sipri said. A third Russian company, United Aircraft, lost $1.3bn in revenue and dropped out of your top 25.

“Domestic competition and lowered government shelling out for fleet modernisation were several of the key challenges for United Shipbuilding on 2019,” researcher Alexandra Kuimova said.

There were as well six companies from Western Europe that accounted for 18 per cent of sales. France’s Dassault Aviation Group reported the largest annual percentage upsurge in sales - up 105 % through the year - since it exported a large amount of its Rafale fight aircraft to customers.

Source: www.thenationalnews.com

TAG(s):