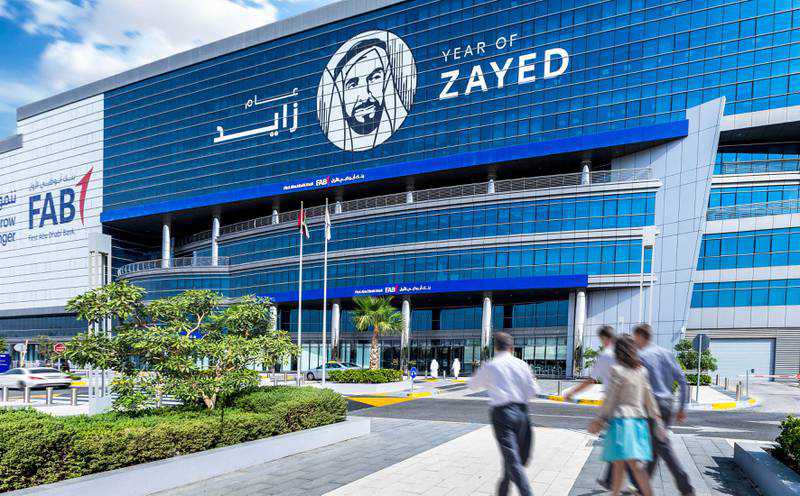

First Abu Dhabi Bank third quarter profit surges 54% on investment gains to $1bn

28 October, 2021

First Abu Dhabi Bank, the UAE’s largest lender by assets, reported a 54 per cent jump in third-quarter profit on the back of higher net interest income and gains on investments as the Arab world's second-largest economy continues to recover from the Covid-19 pandemic.

Total net profit attributable to shareholders for the three-month period to the end of September, climbed to Dh3.9 billion ($1.06bn), the lender said in a statement to the Abu Dhabi Securities Exchange, where its shares are traded. The total profit beat analyst estimates of Dh2.55bn, according to analysts polled by Bloomberg and a projected Dh2.6bn forecast from analysts on Eikon Refinitiv data.

Net interest income during the period rose 10 per cent to Dh3.14bn, while the gain on investment and derivatives surged to Dh2.01bn from Dh391.4 million in the same period last year.

"Our robust pipeline translated to increased business activity and deal execution," Hana Al Rostamani, group chief executive of FAB, said.

"Areas of strategic focus are progressing well, as we continue to build specialised capabilities within our core businesses to support future growth, while accelerating transformation. New product propositions are being rolled out in key areas, capitalising on partnerships and technology to deliver superior solutions and service.

"We also continue to make progress against our international strategy. The integration of our operations in Egypt is on track to be completed during 2022, and we have recently received regulatory approval to establish our first branch in Shanghai, which will further expand our strategic footprint in Asia

"With the UAE at the forefront of the post-pandemic recovery and as we enter the final quarter of 2021, I am optimistic about the opportunities that lie ahead, not only for us as a bank, but also as an engine to the Nation's ambitious vision for the next 50 years and beyond."

Source: www.thenationalnews.com